ANTI MONEY LAUNDERING For Beginners

INTRODUCTION TO anti MONEY LAUNDERING

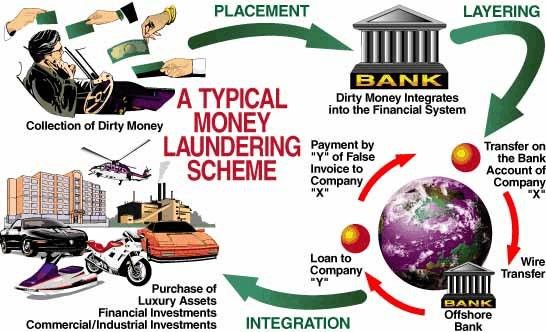

Money laundering is the criminal practice of processing illegally obtained money by placing it into the legitimate financial system in order to make it appear as though the funds were derived from legitimate activities or sources. The purpose of money laundering is to channel ill gotten gains into the financial system so the money launderer can use legitimate financial devices and tools such as bank accounts, securities, checks, etc. Since money laundering involves illegally obtained money, it follows that money laundering requires a predicate crime that is the genesis of the illegitimate funds. Examples of predicate crimes are drug trafficking, racketeering, extortion, illegal arms dealing, bribery and corruption, white collar crimes, and the proceeds of illegal gambling to name just a few.

An example of money laundering would be the payment of ill gotten cash, through a collusive arrangement, to a company that deals extensively in cash such as a retail store, a parking operation, or an ice cream store. This company would then enter the cash on its books as income from its operations, report it to tax authorities, and deposit the cash in its bank account as if it were the proceeds of its legitimate business. These funds can then be invested in other companies, used to pay nominal employees of the company who legitimately work for the criminal syndicate, or use the funds to engage in other commercial activities.

Integration of the illegal funds into the economy helps money launderers hide the original source of the funds. As it becomes difficult to track / trace the source of the money, money launderers are able to enjoy the profits obtained through various criminal activities as if they were legitimate.

The money being transferred in these schemes not only represents the ill gotten gains of criminal activities; it is also used to promote and facilitate further criminal activities, be they drug smuggling, organized crime, terrorism, and to bribe and otherwise corrupt governments, courts, and law enforcement or other engage in other anti social behavior.

Placement Stage

Placement is the first stage in the money laundering process by which the illegal money enters into the financial system. The money launderer who is holding large amounts of cash from criminal activities will break it into smaller sums and introduce it into the economy by means of a legitimate enterprise.

In many ways, placement is the most important stage of money laundering. At the same time, placement is the most difficult step to achieve for the money launderer, and it is the stage where law enforcement has the greatest opportunity to detect and prevent money laundering.

Some of the methods by which launderers place the 'dirty' money into the economy are:

- Cash smuggling: The illegal currency or monetary instrument is physically moved out of one country and into another country with more relaxed controls, making it easier to convert the cash into bank accounts.

- Blending funds: Hiding cash with other cash, setting up front companies, commingling currency deposits of legal and illegal enterprises.

- Purchasing assets: Purchase of expensive items such precious metals, jewellery, or art that can be readily liquidated.

- Structuring: Large amounts of cash is broken into smaller amounts and, over time, deposited into different branches of a financial institution, with each deposit under the mandatory reporting limit of the jurisdiction.

- Purchase of financial instruments: In an effort to further disguise the origin of the money, the launderer will purchase bank cheques and other financial instruments.

Layering Stage

With the cash now in the legitimate financial system (through / in a bank or financial institution), the launderer moves the illicit money around by investing it in various financial instruments or products. This stage of money laundering is referred to as layering. Layering enables the launderer to cut off the link between the crime and its proceeds.

Layering consists of a series of transactions for the purpose of creating a complex and confusing paper trail for the purpose of hiding the origin of the money. Often, layering will involve the use of accounts of multiple "shell" companies, multiple financial institutions, and the use of foreign financial institutions, particularly those in countries with weak anti money laundering laws.

Some of the methods used by launderers in this stage are:

- Investment instruments (purchase and sale of investment instruments)

- Wire transfer (wire funds through a series of accounts at various banks across the globe).

- Disguising transfers (disguising transfers as payments for goods or services).

- Splitting funds (moving funds by splitting them into different denominations or form).

- Prepaid cards (global access to cash via automated teller machines and goods at point of sale).

- Material assets (purchasing assets with cash such as metals, jewellery, or art for example) which is then resold locally or abroad.

Integration Stage

At the integration stage, the launderer aims to reconnect with the illicit funds that were introduced into the financial system at the placement stage of the money laundering process. With the appearance of legitimacy due to layering and placement, the funds can now be utilized by the launderer to purchase financial instruments and large items, such as automobiles, electronics, houses, etc. These new funds, far removed from their illicit source both in terms of geographic location and the manner from which they were obtained, and now in the form of physical goods or financial instruments, are integrated into the legal economy. Once integrated they can be used for any purpose.

MONEY LAUNDERING EFFECTS

Beyond the criminal dimension, money laundering has a negative effect on business. Some of the ways that money laundering negatively affects business include:

- Undermining financial systems (their integrity questioned).

- Expanding crime.

- Financial institutions can become a part of the criminal network itself.

- "Criminalises" society and undermines democracy and the rule of the law.

- Reduces revenue and control of the government.

- Causes unexpected changes in money demand.

- Causes prudential risks to the soundness of banks.

- Contaminates legal financial transactions.

- Increases volatility of international capital flows and exchange rates (due to unanticipated cross border asset transfers).

- Rewards corruption and crime.

COMBATING MONEY LAUNDERING

There is no "one size fits all" approach to preventing and stopping money laundering. Indicators or Red Flags are effective in helping identify potential instances of money laundering. However, Indicators alone are not a sufficient defense against money laundering. A financial institution must have a sound compliance program that instructs its employees on the proper procedures. Financial institutions also must know their customer. Beyond learning the customer's identity, a financial institution should also be familiar with the customers' business so that it will be aware of any changes or alterations in business patterns.

- Risk Based Approach. A risk based approach entails conducting due diligence based on the unique circumstances of an individual customer or an individual transaction. If a customer or transaction is determined to be high risk, then, enhanced due diligence measures should be undertaken.

When dealing with anti money laundering, common risk criteria factored into a risk based approach are customer risk, country risk, and services risk. How much weight is applied to each type of risk depends on the unique circumstances of each case.

Financial institutions should use a risk based approach for all facets of its anti money laundering program. When beginning a customer relationship, a financial institution should take a risk based approach when evaluating that customer and determining whether they want to enter into such a relationship. A financial institution should also use a risk based approach when determining whether it should facilitate certain transactions on behalf of the customers. When evaluating the risk of money laundering, financial institutions must determine how much risk they are willing to take, and then design their anti money laundering programs accordingly.

- Indicators. In any effective compliance program, it is crucial that bankers be able to identify when instances of money laundering are being attempted or occurring. As with other types of financial crime, Indicators or Red Flags are useful tools in identifying and preventing instances of money laundering.

INCONSISTENT TRANSACTIONS

Transactions that are inconsistent with customer's business strategy or profile (e.g., a construction company that starts purchasing large quantities of luxury cars) or transactions which do not make economic sense.

The goal of a business is, generally speaking, to generate the greatest profit possible. Therefore, businesses have an incentive to conduct their transactions in the simplest and most efficient economic way possible to minimise the costs of the transaction, in terms of both time and money, while maximising the benefits. It therefore follows that a transaction designed in an inefficient manner or that makes little economic sense should face further scrutiny to determine the cause for the transaction's structure, if there has been an error, or more importantly, whether the transaction is serving as a vehicle to mask money laundering.

When a customer attempts to make a transaction that is unusual or does not make economic sense, a bank should follow up that request with further questions designed to ascertain a legitimate business reason for the transaction. Perhaps the transaction, when looking at the entire picture, does serve a legitimate purpose. Alternatively, perhaps the transaction is part of a well planned, new venture that the customer has been planning.

Example. A customer who designs and manufactures computer processors applies for a bank guarantee for the purchase of seagoing vessels. The bank should note the request and determine what further scrutiny is appropriate. Potential action could include further inquiries to the customer. The bank should also determine if this particular situation necessitates reporting the transaction to the relevant authorities (MOKAS).

SIMBLE METHODS USED IN MONEY LAUNDERING

There are numerous methods utilized by money launderers to achieve their goals while attempting to avoid detection: over and under invoicing, multiple invoicing, phantom shipments, and falsely described goods and services.

OVER AND UNDER INVOICING

Over and under invoicing for goods and services is an old method of money laundering. In order for this scheme to work, the buyer and the seller must collude with one another. Often the buyer and seller will both be subsidiaries of the same parent company or related in some other manner. In instances of over invoicing, the seller will invoice the buyer for a price that is above the fair market value of the goods being sold. This action will result in increased value for the seller. Conversely, under invoicing relies on a seller invoicing a buyer for goods at a price that is below market value. The buyer then can resell the goods and receive an additional profit for the difference between fair market value and the purchase price paid. Over and under invoicing can be particularly difficult to detect in complex transactions or transactions involving rare goods, as it will be difficult for government officials to determine whether the selling price is at or near fair market value.

Example Over Invoicing. Exporter sells Importer 100 televisions valued at USD 500.00 per television. Exporter invoices Importer USD 100,000 and Importer pays USD 1000.00 per television. In this instance, instead of Importer paying USD 50,000.00 for USD 50,000.00 worth of merchandise, Importer has paid USD 100,000.00, resulting in a USD 50,000.00 windfall for the Exporter.

Example Under Invoicing. Now, same parties and merchandise as above; however, in this instance the Exporter invoices the Importer only USD 20,000.00 for 100 televisions. In this example, Importer has received USD 50,000.00 worth of merchandise for only USD 20,000.00, resulting in a windfall of USD 30,000.00. Importer can then sell the televisions to third parties at market price and will make a much larger profit than if they had paid the fair market wholesale value for the televisions. This is an example of under invoicing

MULTIPLE INVOICING

Another tactic utilised by money launderers is multiple invoicing. In this scheme, a seller will invoice the buyer multiple times for the same transaction. The payments made under the additional invoices will allow the exchange of money between the buyer and seller under the guise that the buyer is paying for goods. Since there is no exchange of goods in relation to the subsequent invoices, the subsequent invoices only serve to give it the appearance of legitimacy.

Example. Buyer / Applicant purchases GBP 500,000.00 worth of cotton from Seller / Beneficiary. Buyer / Applicant applies for a standby letter of credit in favour of Seller / Beneficiary to cover risk of non payment for the cotton. Seller / Beneficiary ships the cotton and when Buyer / Applicant does not make payment on the invoice, it makes a complying presentation and receives payment. One month later, Buyer / Applicant applies for a second standby letter of credit with Seller / Beneficiary as the beneficiary once again. Seller / Beneficiary once again invoices Buyer / Applicant for GBP 500,000.00 of cotton, except in this instance there was no shipment and again the Buyer does not pay. Nevertheless, Seller / Beneficiary makes a demand on the standby and receives payment.

PHANTOM SHIPMENTS

Phantom shipments occur when the exporter invoices the buyer for goods that are not sent. The buyer, working in collusion with the exporter, will make payment on the goods as if they had been shipped and received. Phantom shipments can be achieved through creating and sending false transport documents and invoices which further enhance the illusion that goods were actually shipped. This allows money to be exchanged as though a legitimate trade transaction had occurred.

FALSE DESCRIPTION OF GOODS OR SERVICES

Another common scheme utilised in trade based money laundering is to falsely describe goods or services. In this case, inexpensive goods can be invoiced as expensive goods, causing more money to be transferred than would occur in a legitimate transaction. False descriptions can also be utilised for services since a service is not a tangible object and the price of services can vary greatly based on numerous factors such as the provider of the service, specific case by case requirements, and other factors that cannot easily be detected or monitored by government officials or employees in the financial sector.

Example. An exporter invoices an importer for steel bars at a price of EURO 10,000. However, the exporter actually sends gold bars to the importer worth ten times that amount. The result is the importer has received an undetected profit of EURO 90,000

CONCLUSION

Financial institutions should have in place a response plan to deal with suspected instances of money laundering. This is a crucial component of the compliance program. It should be noted that it is extremely difficult to determine whether a specific transaction is part of a money laundering scheme, and such a determination cannot be made solely based on documentation as most goods are not traded on the public market and thus do not have standardised prices available.

Furthermore, financial institutions often lack access to specific business details to make an accurate determination. However, financial institutions may gain enough knowledge to be able to note when a transaction appears unusual and to make further inquiries when necessary.

Stelios Georgiou

Head Financial Crime Monitoring and Investigations

Compliance Division, Bank of Cyprus